Company Name: Warner Bros. Discovery

Ticker: WBD

Price: $18.15

52-week range: $17.89-$39.70

Shares O/S (m): 2,427

Market Cap. ($B): $44.0

Enterprise Value ($B): $97.9Summary

A combination of factors have created a perfect storm for shares of Warner Bros. Discovery, offering investors with a 12+ months time horizon the opportunity to own a global media powerhouse with the potential to be one of the winners in the streaming wars at an incredibly attractive valuation (7.0x EV/EBITDA, 19.1% FCF yield on 2023E). I believe that shares of Warner Bros. Discovery have the potential to more than double over the next 24 months, with the opportunity to compound at a healthy clip thereafter, ultimately offering multi-bagger potential over a 5 year horizon.

Company Background

Warner Bros. Discovery (WBD) is the result of the merger between Discovery and WarnerMedia. The deal was announced in May 2021 and structured as a Reverse Morris Trust transaction, with WarnerMedia spun out of AT&T and merged into Discovery. AT&T shareholders received 71% of common equity in the new company, which is now led by Discovery’s CEO, David Zaslav.

The deal transformed Discovery from a sub-scale player with terminal value risk into a global media powerhouse with tremendous scale, reach, and resources. In return, $43B of debt were transferred from WarnerMedia parent’s AT&T to the merged company, giving AT&T the opportunity to deleverage its balance sheet and provide it with the financial flexibility required for its ambitious 5G wireless and fiber expansion plans.

With Discovery and WarnerMedia generating respectively $12B and $36B of revenues in 2021, the combined entity is one of the largest media companies in the world behind Disney.

In direct-to-consumer (DTC), WarnerMedia and Discovery’s offerings (respectively HBO/HBO Max and Discovery+) reached 96 million subscribers at the end of 2021, behind Netflix (222 million) and Disney+ (130 million).

The combination of WarnerMedia’s strong franchises and valuable IP with Discovery’s global footprint and deep library of non-scripted content allowed AT&T and Discovery to form a leading content company with the scale and resources to effectively compete in the fast-growing direct-to-consumer business.

Investment Thesis

A winning content combination

The separate companies have been lagging behind their main competitors in direct-to-consumer, but the combination of Discovery and WarnerMedia’s complementary content libraries and production capabilities now provides them with the ability to accelerate growth in their streaming effort. Notably, their content is highly synergistic. By bringing its TV and film studios and its major franchises and IP - DC Comics (Batman, Superman, Wonder Woman, …), Game of Thrones, Harry Potter, … - WarnerMedia provides the ability to create blockbuster content that generates buzz and net adds to a direct-to-consumer offering; while Discovery’s massive library of low cost, unscripted content, offers almost infinite watching hours to every member of the family, thereby helping to reduce churn. Plans for the DTC strategy are not yet finalized and have not been made clear, but I expect the company to bundle together HBO Max and Discovery+ and consolidate all of its content into one offering. Blockbusters from WarnerMedia will drive subscription sign-ups, and Discovery’s content library will be key in retaining them and reducing churn.

WBD is advantaged by its profile and legacy distribution channels

While linear TV is viewed as a melting ice cube and DTC is certainly the future of television, Netflix’s recent results cooled off investors’ enthusiasm for streaming and reminded us of the importance of a balanced monetization model. Streaming only represents about 30% of hours watched in the U.S., and Discovery is still growing its revenues from linear TV (fees and advertising) through price increases, despite customer losses. While the gradual decline of linear TV and the transition to streaming services is likely to continue in the foreseeable future, the cash flows generated by the legacy business and the ability to cover all distribution platforms offers WBD a real advantage compared to streaming pure plays such as Netflix.

This advantage was highlighted by David Zaslav during the Q1 2022 earnings call:

These last few months in our industry have been an important reminder that while technology will continue to empower consumers of video entertainment, the recipe for long-term success is still made up of a few key ingredients. Number one, world-class IP content that is loved all over the globe; two, distribution of that content on every platform and device where consumers want to engage, whether it's theatrical or linear or streaming; three, a balanced monetization model that optimizes the value of what we create and drives diversified revenue streams; and four, finally, durable and sustainable free cash flow generation.

These four points perfectly summarize the WBD’s bull case, particularly when looking at them through the lens of Netflix’s recent hiccups:

World-class content and franchises

Netflix certainly generates buzz around some of its shows, but lacks the strong IP and franchises that WarnerMedia brings (DC Comics, Harry Potter, Game of Thrones, …). Squid Game and Bird Box might generate buzz over a couple of weeks, but I’m not sure anyone is avidly waiting for the Bird Box sequel. Meanwhile, WarnerMedia’s franchises cross over generations and benefit from hype and excitement well before their releases.

Strong franchises create the potential for big hits that can drive net adds and engagement to a streaming platform. It has been reported that over the first three days following its release on HBO Max, Wonder Woman 1984 drove more sign-ups than any other streaming service had recorded over any other three-day period in the prior year. However, it has also been reported that 50% of Wonder Woman 1984 viewers churned within 6 months, highlighting the importance of offering a deep library of filler-type, differentiated content - something that Discovery brings to the combined offering.

With its content production studios, WBD has the ability to produce and control the content IP, positioning it in an advantageous position compared to competitors that rely on third-parties for all of their content.

Distribution of that content on every platform and device

Streaming is certainly the future, but linear TV still has an important role to play, as it still accounts for about 70% of watching time according to Nielsen. Theaters are still important as well: pre-pandemic, tickets sold in the U.S. have been declining at a very moderate pace, but box office revenues have been consistently increasing due to rising average ticket prices. Whether theaters have been permanently impaired by the pandemic remains to be seen, but there is likely a good chance that blockbuster movies will still have a place on the big screen.

For the most part, DTC subscribers still go to the cinema and watch linear TV. Much akin to what we are seeing in retail with the move to omni-channel, media companies able to reach consumers on every platform (linear, theater, streaming) have an advantage by building repeat engagement with their content and optimizing its monetization.

Balanced monetization model

Netflix only monetizes its content through subscription revenues, and increasing competition in the DTC space puts pressure on its pricing power while forcing it to invest increasing amounts of money in content production, ultimately pressuring both top and bottom lines.

On the other hand, Warner Bros. Discovery benefits from cash flows generated through other platforms. When a blockbuster movie is released on its streaming platform, it already had generated a profit in theater - essentially creating the content for the streaming platform for “free” (or, at least, at a reduced cost basis). For instance, The Batman has generated $368m in the U.S. box office (for a total of $760m worldwide), making it the 51st top grossing movie of all time, despite being released on HBO Max on April 18, just 45 days after its theatrical release. And it is breaking viewership records there as well. This is a clear advantage, as WBD is able to generate greater returns for a given amount of content spend.

Durable and sustainable free cash flow generation

Good content, combined with wide distribution and a balanced monetization model results in strong, durable free cash flow generation.

WBD expects to generate more than $8B of FCF in 2023, while investing $20B in content production. This leaves room to further accelerate investments to develop its streaming platform, while Netflix is still burning cash with a broadly similar content budget. I believe that the FCF generation profile of the legacy business and the ability to monetize content on various platforms offers a strong competitive advantage in fueling the transition to the next media consumption medium.

To conclude, while Warner Bros. Discovery does not currently have Netflix’s scale in DTC, it has a far more balanced profile that provides it with diversified revenue streams and cash flows, and the ability to develop its streaming business without the need of overspending on exclusive DTC content. The ability to monetize the same content on multiple platforms gives WBD an advantage despite its current subpar streaming scale, optimizing its returns on content investments. In addition, its broad media and advertising experience allowed it to already experiment with ad-free and ad-light tiers (something even Netflix is now considering), which should help the company find the most optimal recipe for its streaming offering.

Management: media & capital allocation expertise

While David Zaslav is a controversial figure (partly, at least, due to his egregious compensation package), I believe that he and CFO Gunnar Wiedenfels are the perfect fit to lead Warner Bros. Discovery, combining a broad and deep media industry expertise with strong capital allocation skills and a constant focus on ROI.

Every comment in the Q1 earnings call point to the discipline the team has:

We have no religion about any one platform or window versus another, and we intend to approach each and every decision through a lens of enhancing asset value against a set of financial returns. Our goal is to maximize long-term shareholder value and asset value, not just subs. We will not overspend to drive subscriber growth.

Our focus is to invest in content and platforms that extend the life and return of our global IP, and position us to drive greater returns out of each dollar of content spend than our peers and to ultimately drive free cash flow. And we will refine our capital allocation and content windowing decisions accordingly. We can maximize the distribution of our global IP in a number of ways guided by simplicity and choice for consumers.

As you've heard me say, we are not trying to win the direct-to-consumer spending war. To begin with, we firmly believe the two content companies coming together have unique advantages, including the largest film and television library from Warner, largest domestic and international lifestyle library from Discovery, and significant global live sports and news. This strong foundational offering will allow us to invest in scale smartly and more uniquely position us in our drive to become a fully scaled global streaming leader. We come into this transformational moment with great creative momentum.

WarnerMedia is an extremely attractive asset, but it has unsurprisingly been mismanaged under AT&T ownership. Gunnar Wiedenfels, WBD’s CFO, was quite critical on the latest earnings call and I expect the Discovery management team to bring more financial discipline. There is little doubt that a team focused on ROIC is now in charge:

But if I take a step back here and just look at, call it, the past 15 months for WarnerMedia sort of as a carve out-group, we're looking at more than $40 billion of revenue and really virtually no free cash flow. And right or wrong, management has made a decision to invest a lot of the incoming funds into a number of investment initiatives. And as I'm looking under the hood here again, CNN+ is just one example, and I don't want to go through sort of a list of specific examples, but there's a lot of chunky investments that are lacking what I would view as a solid analytical, financial foundation and meeting the ROI hurdles that I would like to see for major investments.

Of course, working with and motivating creative executives at movie studios requires more than ROI hurdles. And Zaslav is a perfect complement to Wiedenfals - he is an exceptional salesman and very good at building teams and relationships. The stark contrast with AT&T CEO John Stankey first appearance at WarnerMedia, described in a Vanity Fair article published in last October, speaks for itself:

There had been a similar town hall in June 2018, when John Stankey, the veteran AT&T executive who’d originally been appointed to run WarnerMedia, appeared alongside Richard Plepler, the long-running leader of HBO. It didn’t go over well. Stankey sent a collective cringe through WarnerMedia’s creative community, rattling off jargon like “hours of engagement” and “monetize through alternate models of advertising.” A video of the conversation was leaked to the Times, and eight months later, Plepler left the company. (Stankey is now AT&T’s CEO.)

Zaslav made a much better first impression. He talked about his origins and his family. He talked about talent and storytelling. He talked about heritage and creativity. Sometimes, new bosses come in acting like they know everything. Zaslav’s message was the opposite. “We are not coming in here thinking that we know the answers,” he said. “There is a ton we don’t know.” In the words of a rank-and-file employee who was watching from home: “He nailed it.”

In light of their past actions and recent comments, I have little doubt that the Discovery team will be able to better manage the creative talents at WarnerMedia than AT&T, while improving the company’s financial profile. There are of course still uncertainties around dynamics between the different platforms, how to manage the content licensing strategy (what to keep exclusivity on versus what to license, what would be the impact of moving from exclusive to non-exclusive licenses, etc). This is a risk to keep in mind and to monitor, but I trust the experienced team of media executives at WBD to find the optimal solution over time.

Are streaming economics really that great?

One key question remains - longer terms, are streaming economics actually accretive for legacy media companies? This is the million dollar question, as the transition is still in its early days and the answer is unclear for now. What we know for sure is that linear TV and theaters are still playing an important role in the media landscape, and will likely for years to come. One day, maybe streaming will indeed take over - in that case, it seems likely that the industry will consolidate into a handful of streaming services, and I cannot think of many companies better positioned than WBD to take advantage of it: strong franchises and IP, deep content library, scripted and unscripted content, kids content, news, sports - it has it all.

Once sufficient scale and consolidation will be reached, I believe that the streaming model will likely be accretive for the leading content companies:

Zaslav declared that Discovery has been under-monetized as part of the cable bundle. Discovery generates 20% of cable viewing, but only receives about 7% to 8% of distribution revenues, or $3.0 to $3.5 per subscriber per month. In contrast, Discovery+ ARPU’s is $7 to $10 depending on the version. So ballpark and to break-even at current price levels, Discovery needs 1 net add for every 2 cable subscriber lost. In the U.S., it could essentially cover its U.S. Networks segment revenues by getting to Netflix’s scale ($7.7B revenues in 2021, corresponding to 75 million subscribers at $8.5 ARPU).

Ultimately, if streaming is the winning medium of video content consumption, it’s hard to imagine that viewers will be offered fragmented DTC options. Instead, it seems more likely that it will result in a handful of big players offering the full scope of content: movies, scripted series, non-fiction, news, sports, … And in that context, it is hard to imagine that a company controlling the full value chain, from content production to distribution, and owning the customer relationship, will not be able to generate at least the same amount of revenues and profits than via the cable bundle, especially if it was under-earning in the bundle.

Warner Bros. Discovery has everything needed to successfully navigate the evolving media landscape and the transition to streaming. It combines WarnerMedia’s exceptional content, IP and franchises with Discovery’s global scale and deep library of low cost, unscripted content. It has something for each member of the family. Its legacy business is generating massive amounts of FCF. And it is lead by a great management team. While the integration efforts are still ongoing, Warner Bros. Discovery seems to have a very good chance of being successful in its transition. And as we will later see, it currently trades at a strikingly undemanding valuation.

Why This Opportunity Exists?

There are a couple of reasons as to why shares of Warner Bros. Discovery are trading at what I believe is a very wide discount to intrinsic value:

Spin-off dynamics: 71% of shares have been spun-off to AT&T shareholders, of which ~46% are held by retail investors, and I assume that most of them own the AT&T stock for its dividend. Some of the largest holders are also dividend-focused ETFs, which would be forced sellers (Warner Bros. Discovery will not be paying a dividend).

Uncertainties around integration: the merger is a huge deal, and the integration is far from being over. The team is still finalizing the combined financials so investors do not have a clear view of the various financial statements and the go-to-market strategy in streaming for the combined entity has not yet been clearly laid out.

Debt load: the company currently has $58B of gross debt, resulting in a leverage of approximatively 4.5x EBITDA. It is a high level of debt, especially for a company that needs to invest significant amounts in content production.

Netflix’s spillover: following its latest two disappointing quarterly earnings releases, shares of Netflix are down 63% since releasing its FY21 results, from $508 to $190. The company lost 200k subscribers last quarter and guided to a loss of up to 2 million subscribers in the second quarter. These issues have likely cooled off investors’ sentiment towards streaming. Since it reported Q1 2022 earnings on April 19, Netflix shares tumbled 45% while Disney, Paramount and Warner Bros. Discovery are down by respectively 15%, 20%, and 26% (vs. 8% for the S&P 500).

Market drawdown: compounding the three above-mentioned issues, the S&P 500 is down by 8% since the spin-off occurred.

I expect most of these issues to be resolved in the coming couple of months. Short-term, adverse spin-off dynamics should subside over the next few weeks. Since the distribution of 71% of WBD’s shares outstanding to AT&T shareholders on April 11, 540 million or 22% of shares have been traded. With an estimated 47% retail ownership of AT&T shares and roughly 25% of institutional ownership composed by dividend-focused ETFs, I would expect selling pressure to subside once ~50% of shares have been traded (assuming respectively 80% of retail and 100% of dividend ETFs sell, although the ETF dynamics are likely overstated given other ETFs could now add WBD). Based on the last two weeks of average daily volume, this would mean at most another ~20 trading days for selling pressure to subside, or towards the end of May.

As the WBD team is working on the relaunch of their direct-to-consumer strategy, more details should be unveiled over the next months, possibly as early as around Q2 earnings. The next earnings release will also be the opportunity for analyst to get more confident on the combined entities numbers and particularly the balance sheet, as questions were asked during the last call that WBD’s CFO could not yet answer as the audited financials were not yet available. Details provided on financials and on the DTC strategy should help alleviate some of the uncertainties around the company, and help investors get more comfortable with the story and look through a 2022 year that is expected to be messy due to the integration efforts.

And next year, WBD will be able to prove its FCF generation potential, leverage will come down, it will have grown its DTC subscribers, and investors should become more comfortable with the story. In addition, I expect a share buyback program to be reinstated towards the end of 2023 or early 2024 once leverage targets are achieved.

The gradual resolution of these factors should attract investors that might have stayed on the sideline given the uncertainties around the merger, and help the stock rerate from its currently depressed valuation.

Valuation

At the current share price of $18.15, Warner Bros. Discovery has a market capitalization of $44.0B (using 2,427 million shares outstanding). While we do not yet have the consolidated balance sheet for the merged entities, Discovery reported $15.1B of gross debt and $4.2B of cash at the end of Q1 2022. In addition, $43B of debt have been transferred from AT&T when it spun off WarnerMedia, resulting in a net debt position of $53.9 and an enterprise value of $97.9.

During the transaction presentation in May 2021, management guided for $52B of revenues and $14B of adjusted EBITDA for 2023, as well as a target of approximately 60% FCF conversion (resulting in $8B of FCF). This guidance includes the phase-in of $3B in synergies:

Discovery’s management reiterated its confidence in hitting its guidance during the Q4 2021 earnings call, and they seem confident that synergy opportunities should exceed the $3B target (according to John Malone, they will even “easily exceed $3B to $4B a year”). In 2020, with the adverse impact of Covid on the advertising market and theatrical releases, the combined entities managed to generate $12B of EBITDA on $39B of revenues, so the 2023 EBITDA target looks largely achievable given the expected synergies.

With these assumptions, Warner Bros. Discovery currently trades at 7.0x EV/EBITDA and a 19% FCF yield on a forward basis. It should be noted that the guidance given by management on FCF (and hence this valuation) already includes $20 billion of spending on new content, largely in line with Netflix.

The reasons for this discount have been described above, and it strikes me as incredibly cheap for a global media powerhouse with strong franchises and IP and that has everything needed to succeed in the streaming war. A more appropriate multiple given the recent turmoils in the sector is anyone’s guess, but a ~8% FCF yield or 11x to 12x EBITDA target does not look particularly crazy for a media giant that should be able to grow over the next several years. This would translate into a $41 to $47 share price, or 126% to 159% upside over the next 12 to 24 months.

There are still uncertainties around management’s targets despite the confidence they reiterated, but there is potentially about $1B (and maybe more) upside to the initial synergies target which should help offset any unforeseen headwind. In addition, the net debt used is at close of the transaction, and leverage should come down relatively quickly thanks to Discovery’s FCF generation, thereby further reducing the EBITDA-based valuation to an even lower multiple looking out a few quarters.

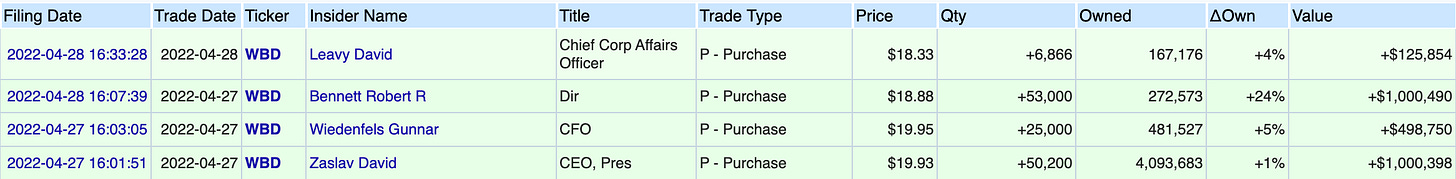

As a side note, management seems to agree on the valuation given recent insider purchases this week following Q1 2022 results. While the amounts are not significant compared to their compensation and current holdings, it is certainly nice to see insider cluster buying:

Looking further out, if the company’s DTC efforts succeed in accelerating top-line growth, it doesn’t take a lot of imagination to see Warner Bros. Discovery compounding FCF/share for years to come, particularly with share buybacks. In that scenario, which would also likely result in a further compression in the FCF yield, a share price in the high double digits or low triple digits does not seem out of reach, offering investors with potential multi-bagger potential over the next couple of years.

Risks

Leverage: WBD has $58B of gross debt and is today levered at approximately 4.5x Net Debt/EBITDA, which is significant for a company that needs to accelerate its content investments.

Mitigant: Discovery is a FCF machine and leverage is already tracking below where it was announced in May 2021. The company today expects to achieve its 3x leverage target meaningfully sooner than expected. Following the Scripps Networks acquisition by Discovery, this very same management team reached its two-year leverage target in less than a year.

Integration and synergies: the integration process is ongoing, we have yet to see the DTC strategy, and WBD could under-deliver on synergies.

Mitigant: the WBD management team already has experience from the $15B Scripps Networks acquisition. They ultimately captured more than $1 billion in cost savings, compared to an initial guidance of $350 million. Their Integration and Transformation Office has been working on the merger since the deal announcement, which should help WBD hit the ground running.

Cable bundle unraveling: linear TV is a melting ice cube and the cable bundle could unravel quicker than expected, putting pressure on cash flows.

Mitigant: Discovery has been able to offset customer losses by pricing, and likely still has untapped pricing power as it generates 20% of cable viewing, but only receives about 7% to 8% of distribution revenues. In addition, the vast majority of cord cutters are not dropping TV entirely but moving to streaming services, and WBD should be able to capture DTC subscribers to offset cable revenues losses.

Streaming economics: the DTC business model could be dilutive to revenues and earnings compared to the cable bundle.

Mitigant: Discovery’s ARPU is higher in DTC than within the cable bundle. In addition, streaming should consolidate around a couple of key players that would control the full value chain including distribution and consumer relationship, and should therefore capture a larger share of the industry’s profit pool.

Conclusion

A combination of a technical overhang driven by spin-off dynamics, uncertainty on the company’s DTC strategy, high debt load, and ripple effects from Netflix’s disastrous quarter have created a perfect storm and the opportunity to acquire shares in a global media behemoth at an incredibly attractive valuation of ~5x next year’s FCF.

WBD has everything every Netflix bull would want: streaming growth, strong franchises and IP, deep content library, and more importantly - it is gushing cash despite content investments rivaling Netflix.

Management had time in the months leading up to closing of the merger to develop its strategy and synergy plans and is hitting the ground running. Now is time to execute. If they do, shares of Warner Bros. Discovery have the potential to re-rate substantially.

Nice analysis, but I think you may be drastically underestimating the overhang. Roughly 50% of all stock trading is by high frequency bots who round trip and don't hold their positions...so it is just padded noise to the volume levels. You are also assuming that all of the remaining volume represents selling by ex-T shareholders, and not by short term holders or ex-DISCA holders. If you relax your assumptions, you probably have a share overhang that lasts well thru summer especially as trading volume normalizes.

Love this article! Very well done. We came to very similar conclusions + valuation despite me just stumbling across your article a few minutes ago https://scroogecapital.substack.com/p/warner-bros-discovery-wbd?r=orfi8&utm_medium=ios